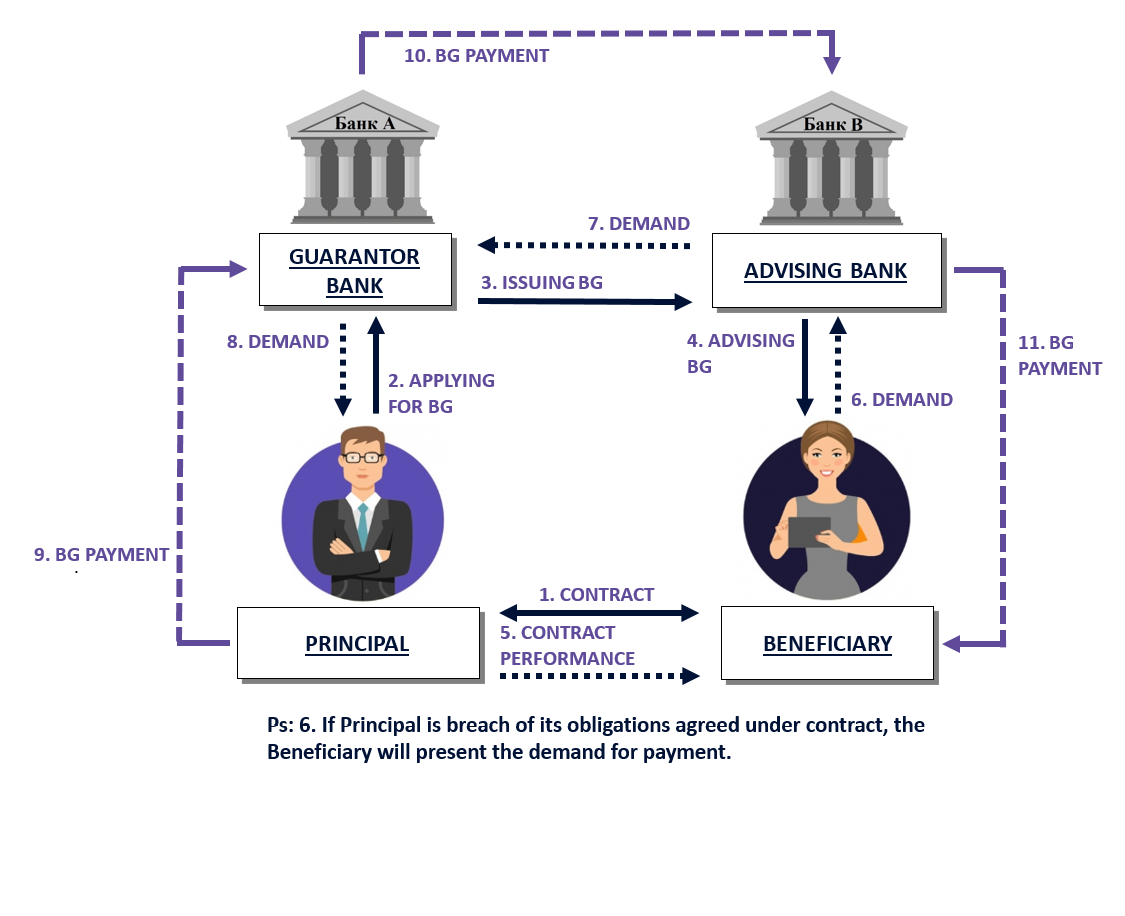

Bank guarantees represent a more significant contractual obligation for banks, such as real estate contracts, international trade and infrastructure projects. This can be used to essentially insure a beneficiary of the guarantee from loss or damage due to non-performance by the other party in a contract.

We offer the following services:

When Bank Guarantee is used?

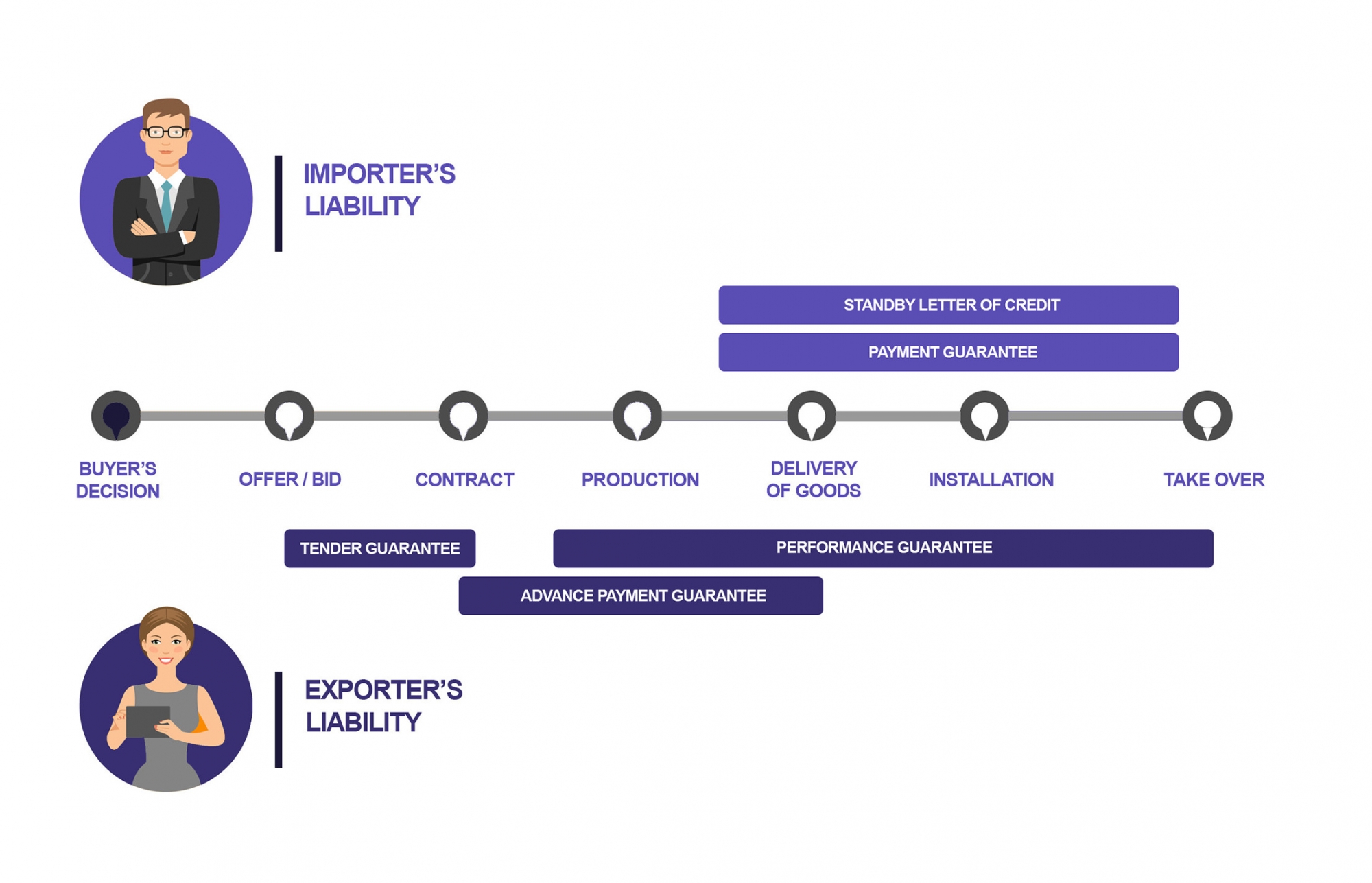

Typical bank guarantees in trade cycle:

| outward bank guarantee /BG/ | fees & commissions | |

|---|---|---|

| Issuance of covered BG | 50 USD | |

| Issuance of uncovered BG | Issuance | 0.1% (min 50 USD, max 250 USD) |

| Risk fee | 1%-5% (annual rate) | |

| Per each demand payment | 50 USD | |

| Additional service fees requested by customer: | ||

| Amendment | 40 USD | |

| Cancellation | 50 USD | |

| Sending an injury | 10 USD | |

Ps: If bank guarantee charges and/or costs cannot be collected from the beneficiary, the applicant is liable for such incurred charges. | ||

| INWARD BANK GUARANTEE /BG/ | FEES & COMMISSIONS |

|---|---|

| Advising of the BG | 20 USD |

| Sending demand for payment | 50 USD |

| Additional service fees requested by customer: | |

| Advising of the BG amendment | 10 USD |

| Cancellation | 25 USD |

| Sending an inquiry | 10 USD |

| Ps: Customers are charged for courier services. | |